Ethereum Supply Crisis Intensifies as Total Value in ETH 2.0 Surges Past $9 Billion

Brian Njuguna Apr 15, 2021 01:25

Crypto analyst Joseph Young has pointed out that the Ethereum supply crisis is intensifying.

Ethereum (ETH) is on overdrive as the second-largest cryptocurrency based on market capitalization continues to record new highs. ETH’s all-time high (ATH) stands at above $2,400 with a market capitalization of $275.85 billion, according to CoinMarketCap.

Crypto analyst Joseph Young has pointed out that Ethereum's supply crisis is intensifying. Therefore, based on market forces, high demand and a slackened supply usually trigger a price increase, as is the case with Ether.

For instance, on-chain metrics provider Glassnode has revealed that the number of addresses sending Ethereum has reached a 3-year high of 13,224. Conversely, it is speculated that ETH worth at least $718 million left crypto exchanges in the past week.

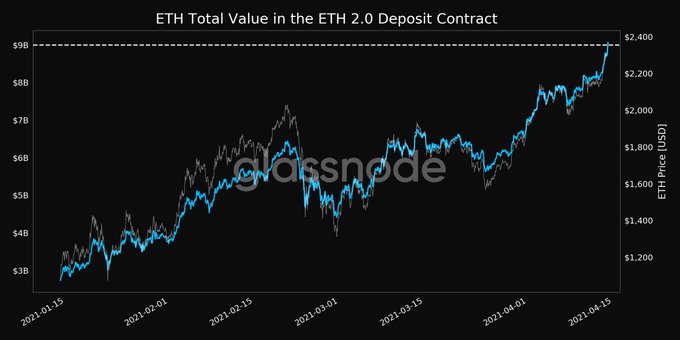

Total value locked in Ethereum 2.0 pushes above $9 billion

Despite Ethereum 2.0 being launched in December 2020, more investments continue being locked in this deposit contract. According to Glassnode:

“Total Value in the ETH 2.0 Deposit Contract just went above $9,000,000,000. Current value is $9,065,798,117.”

This is an indication that investors are betting big on this deposit contract.

ETH 2.0 is seen as a game-changer that seeks to transit the current proof-of-work consensus mechanism to a proof-of-stake framework, which is touted to be more environmentally friendly and cost-effective.

The proof-of-stake algorithm allows for the confirmation of blocks to be more energy-efficient and requires validators to stake Ether instead of solving a cryptographic puzzle.

Additionally, Ethereum’s transition to proof-of-stake will allow the blockchain to see upgrades, including sharding, which would improve scalability.

Market trader Michael van de Poppe believes that Ethereum is still ready for continuation to a new higher high of above $4,000.

Time will tell how Ethereum’s journey to the moon continues shaping up because its renewed upsurge is backed by various bullish fundamentals. For example, in March, payment giant Visa Inc. announced that it has settled for the Ethereum blockchain to undertake USDC transactions.

Image source: Shutterstock

.jpg)