TOKEN

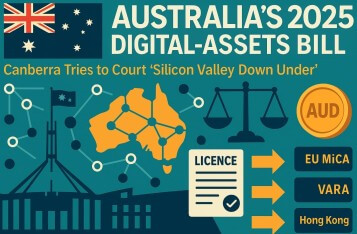

Australia's 2025 Digital-Assets Bill: Canberra Tries to Court 'Silicon Valley Down Under'

Australia's upcoming Digital Assets Bill aims to establish a clear licensing framework for crypto platforms by 2026. It could attract investment, but concerns about compliance costs and fragmented regulations persist. The draft will be consulted in August 2025, with a focus on a Digital-Asset Platform Licence (DAPL) and stable-coin rules. If successful, it may position Australia as a hub for digital innovation. Investors are eager for clarity on fees and regulations.

Tokenised Treasuries Top US $10 B: BlackRock and Franklin Turn a Talking Point into a Market

Tokenized Treasuries have topped $10 billion, led by BlackRock and Franklin Templeton, offering risk-free yields and 24/7 trading, with growth expected to $20 billion soon.

Scorpion Casino Launches Exciting Easter Promo with 40% Bonus Token Offer

Scorpion Casino kicks off an enticing Easter promotion, offering a staggering 40% additional tokens with purchases using the code EASTER40, amidst a successful pre-sale campaign.

Token vs Coin: What's the Difference?

Crypto coins and tokens are two common but distinct types of crypto. Let’s explore the distinctions, creation processes, and roles within the crypto ecosystem.

FLUUS Announces $FLUUS Token Presale On FantomStarter Launchpad

Crypto payment startup FLUUS announced it will be conducting a presale of its native token $FLUUS on the FantomStarter launchpad. The token will be available to buy at a discounted rate on the platform from May 2 - 23, with whitelisting available until May 17, before it becomes available to trade publicly on major cryptocurrency exchanges from May 24 onwards

Decentralized Perpetual Exchange PairEx Announces Beta Trading Competition with Up to 8,888 USD ARB & PEX Tokens

PairEx.io, a decentralized perpetual exchange built on the Arbitrum network, is excited to announce its beta trading competition with a prize pool of up to 8,888 USD equivalent in ARB and PEX tokens. The competition, which is now live, offers traders the opportunity to showcase their trading skills and win lucrative rewards.

New Meme Coin DigiToads (TOADS) token to list on BitMart Exchange

The crypto market has been red hot recently. Bitcoin (BTC) ripped past $30,000, Ethereum (ETH) staking withdrawals will go live, breaking the $2,000 price point whilst Bitcoin (BTC) dominance dropped while its price climbs means it might be the beginning of an altcoin season.

TemDAO World Heritage Project Helps the Cultural Sector through Democracy-Fueled Donations

TemDAO is a world heritage project that seeks to protect and preserve cultural assets through donations and democracy. The project, powered by the $TEM token, ensures the long-term sustainability of global cultural sites.

THORChain Pauses Network Amid Reports of Vulnerability

THORChain has temporarily halted trading due to a potential network vulnerability, causing its native token, Rune, to fall 5% in value.

My Neighbor Alice makes history on NFTb by becoming the first native token on the platform.

My Neighbor Alice native token, ALICE, will soon be available to trade with other currencies on the Binance-backed Web3 Gaming platform, NFTb.