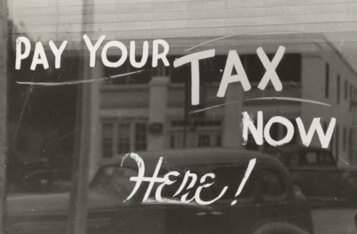

Search Results for "crypto tax-loss harvesting 2025"

South Korean Tax Specialists Advocate for Lowered Crypto Taxation

Members of the Korean Tax Policy Association are calling on the government to consider applying a low-level tax on crypto transactions. The South Korean administration is contemplating taxing cryptocurrencies as part of its tax reform plan for 2021, but specialists feel it requires in-depth conceptualization.

Is Bitcoin Going To Experience Its Biggest Weekly Loss Of 2019 This Week?

For the first time in over six months, Bitcoin’s acceptance has been below key support. Yesterday, the prices plummeted below a four-month low of $7800 and this phase of price volatility lingers.

Spain To Draft New Bill That Will Enforce Full Crypto Holding Disclosure From Citizens

Spain is drafting a bill that will make it mandatory for crypto asset holders to disclose the value of their assets for tax purposes.

UK's Tax Authority Ready to Invest Up to $130,000 in Blockchain Analytics Tool to Track Crypto Cybercriminals

The UK tax authority HM Revenue and Customs (HMRC), is looking for an analytics tool using blockchain to enhance the process of identifying criminals who are trading in cryptocurrencies online.

Barstool Sports Founder Dave Portnoy to Dump Bitcoin and Chainlink (LINK) After $25,000 Loss

Dave Portnoy announced that he is done with cryptocurrency and Bitcoin after undergoing a loss of $25,000 due to market crash.

IRS Updates 1040 Income Tax Form, Lays Traps for Crypto Tax Cheats

The IRS plans to update the 1040 income tax form for 2020 to make it more difficult for taxpayers to avoid declaring their crypto assets.

Trump’s Proposed Capital Gains Tax Cuts Could Benefit Ethereum 2.0 Stakers

President Donald Trump has proposed a capital gains tax cut which may greatly benefit United States cryptocurrency traders—particularly those planning to stake on Ethereum 2.0.

Bitwala Incorporates CryptoTax for Better Tax Reporting

Bitwala, a German-licensed Bitcoin banking service application, announced its new integration remedy with CryptoTax, an entity that assists crypto users to adhere to yearly tax declaration deadlines. This will be instrumental in solving crypto tax headaches.

Crypto.com Partners with Leading Tax Providers to Simplify Reporting Process

Crypto.com, a pioneering payment and cryptocurrency platform, has partnered with three reputable tax providers namely, Token Tax, CryptoTrader Tax, and CoinTracker for simplified tax reporting with the click of a button. This decision was arrived at following requests by the Crypto.com community to be tax compliant.

South Korea Proposes 20% Capital Gains Tax on Cryptocurrency Commodities

South Korea’s parliament has put forward a bill that could see crypto profits taxed by up to 20% as members argue that cryptocurrencies are commodities.

OECD Will Launch International Crypto Tax Standards in 2021 says Tax Director

The director of the OECD’s Centre for Tax Policy and Administration has revealed that the OECD will release an international tax reporting standard for crypto assets in 2021.

South Korea Contemplates Imposing 20% Tax on Cryptocurrency Proceeds

The South Korean administration might consider categorizing proceeds from cryptocurrency transactions as other income that is subjected to 20% tax, such as prize-winning or lottery.