Search Results for "exchange traded funds"

Wilshire Phoenix Files for Publicly Traded Bitcoin-Backed Fund Approval Seeking to Challenge Grayscale’s Dominance

The New York-based investment company, Wilshire Phoenix has filed the s-1 registration statement with the SEC for a publicly-traded Bitcoin fund in accordance with regulatory requirements.

Morgan Stanley Becomes First US Bank to Offer Bitcoin Funds to Its Clients

Morgan Stanley is offering its clients access to Bitcoin (BTC) investments.

German Deutsche Borse Exchange Seeks to Launch New Bitcoin Exchange-Traded Product for Trading

Bitcoin the world’s largest cryptocurrency is making another notable milestone in crypto history as it will be the first crypto asset listed as an exchange traded product (ETP). The company announced the exchange-traded product, popularly known as the Bitcoin exchange-traded crypto (BTCE) - is Bitcoin-backed security that would be listed and traded on Deutsche Borse’s Xetra market-based in Germany. ETP is a financial instrument whose value is based on the underlying security (such as currencies, bonds, and stocks) and is traded on stock exchanges.

Bitwise Pulls Bitcoin ETF To Sort Through SEC Response

Bitwise has officially withdrawn its Bitcoin exchange-traded fund registration filing from the United States Securities and Exchange Commission.

KuCoin Exchange Restores All Token Deposit and Withdrawal Services Following Massive Hack

KuCoin announced yesterday that the withdrawal and deposit services for all tokens will finally be resumed on the crypto exchange.

Upbit Exchange Hacked For 50 Million Dollars in Ethereum

CEO of Upbit, wrote a report explaining the reasons why deposits and withdrawals were not functional on the exchange at the moment, noting that a shocking total of 342,000 ETH were stolen from the Upbit Ethereum Hot Wallet.

17,000 Customers Claim Refund from Collapsed Canadian Crypto Exchange QuadrigaCX

Ernst & Young, the trustee of the now-bankrupt cryptocurrency exchange QuadrigaCX, published a report showing that almost 17,000 people have filed for the remaining assets of the crypto exchange. EY assumed control of the crypto exchange in February 2019 after QuadrigaCX filed for bankruptcy. Ernst & Young took over custody of QuadrigaCX’s assets following the alleged death of Gerald Cotton, the founder of QuadrigaCX, who held the private keys to the crypto holdings, in January 2019. The report indicates that as many as 16,959 people have claimed assets ranging from Litecoin, Bitcoin, Ethereum, Bitcoin Gold, Bitcoin SV, and Bitcoin cash, along with US dollars and Canadian dollars.

Bitcoin Miners Are Not Selling But Accumulating Their Crypto Funds

Glassnode data shows that miners are not willing to sell their Bitcoins amid a market wide exchange shortage of the cryptocurrency. The shortage comes as institutions continue buying crypto assets in droves.

Bithumb Crypto Exchange Puts Itself Up for Sale Amid Fraud Probe

Bithumb cryptocurrency exchange is set up for sale amid accusations of the alleged fraud.

Losing Access to your Crypto Wallet: Dangers and How to Not Lose your Funds?

Dmytro Volkov is the CTO at CEX.IO. He optimized the technology and processes at the exchange, as well as the trading and analytics systems and integrations with external systems. Created the CEX.IO Broker platform to trade derivatives. Also, he has over 15 years’ work experience in IT, including over 10 years in the financial market, and is an author of trainings on financial and tech topics.

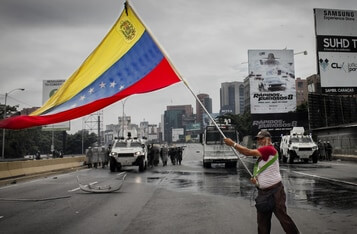

Chainalysis: Venezuela’s State-Owned Crypto Exchange Possibly Used by Maduro Regime to Launder Funds

Blockchain analysis company Chainalysis wanted to find out whether the claims of whether Petro aiding Venezuelans are true.

Iconic Funds to Issue First Exchange Traded Product for Bitcoin on a Regulated Market

Iconic Funds, a global crypto asset management firm, has said it will issue an Exchange Traded Note (ETN) for Bitcoin of up to 100,000,000 Notes, tracking the NYSE Bitcoin Index (Ticker: NYXBT). The Notes may be subscribed to by qualified investors with both EUR and BTC, with a minimum subscription size of 100,000 Notes and an issue price of €1,00 per Note. Iconic Funds will apply for admission to trading of the Notes on the regulated market of the Luxembourg and Frankfurt Stock Exchanges in Q4 2019. The Notes will have a German ISIN.