Bitcoin’s Social and Trading Volumes Hit a 5-Week High as Address Activity Surge to a 3-Week High

As Bitcoin (BTC) continues testing the $40K waters, its social and trading volumes are going through the roof, as acknowledged by on-chain metrics provider Santiment.

As Bitcoin (BTC) continues testing the $40K waters, its social and trading volumes go through the roof, as acknowledged by Santiment.

The on-chain metrics provider explained:

“How did Bitcoin recover to $40K out of the blue? 3 of our key leading metrics all skyrocketed! BTC’s social and trading volumes hit a 5-week high, and address activity hit a 3-week high. When this trio jumps in unison, good things typically happen.”

Bitcoin’s address activity is also not being left behind because it hit a record-high in the last three weeks. Recently, the number of daily active BTC addresses surged by 44.1%.

Therefore, Bitcoin daily active addresses tend to be correlated with the price action, given that investors often follow the price rather than use the asset.

Heating Bitcoin futures markets

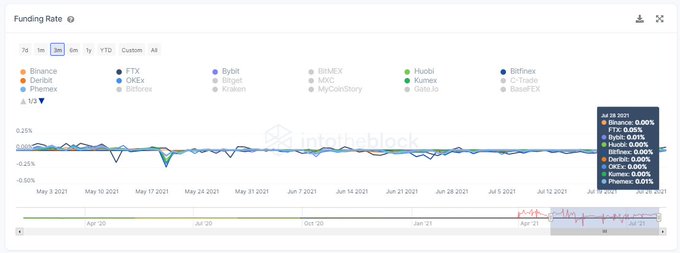

According to data analytic firm IntoTheBlock:

“Alongside the return to $40K, Bitcoin futures markets are heating up once again. Funding rates are once again neutral or positive across several major exchanges, pointing to a majority of long positions being opened over the past few days.”

BTC funding rate recently flipped over to positive as 2.1 million returned to be profitable. The crypto community had been waiting with bated breath to see Bitcoin’s next move as low volatility continued engulfing this market.

Is Institutional money back?

Jan Wuestenfeld, an on-chain analyst, believes that a negative correlation between the dollar index (DXY) and Bitcoin could signal a return of institutional money in the BTC market. He pointed out:

“The USD index (DXY) and Bitcoin’s price have started to show a negative correlation again. This negative correlation has been there this bull-run until the beginning of this year and then did break down. Of course too early to tell, but it might be an indication that inst. money is back.”

Given that 325,000 BTC was previously purchased at this level with significant resistance expected around $42K, the current upward momentum will continue to be observed.

Image source: Shutterstock

.jpg)