ETH Holdings on Exchanges Drops Below 18% in 31 Months

ETH holders are still confident that an uptrend is in the offing as they have been withdrawing their holdings on crypto exchanges in droves, as acknowledged by crypto analytic firm Santiment.

The second-largest cryptocurrency Ethereum regained momentum recently after breaking through the psychological price of $2,100. ETH was down by 3.58% in the last 24 hours to hit $2,035 during intraday trading.

Ethereum has been trying to renew its upward momentum following the recent market crash, which saw its price nosedive from an all-time high (ATH) of $4,350.

ETH holders are still confident that an uptrend is in the offing as they have been withdrawing their holdings on crypto exchanges in droves, as acknowledged by Santiment. The crypto analytic firm explained:

“Ethereum holders continued to make history by lowering the percent of ETH held on exchanges to its lowest ratio since November 2018. Dropping below 18% for the first time in 31 months lowers the risk of a future major selloff.”

Holding is usually bullish because investors withdraw their cryptocurrencies from exchanges and keep them in digital wallets or cold storage for future purposes.

A shift to Ethereum’s POS could fire up the $40 billion staking sector

According to JP Morgan analysts, a transition from the current proof-of-work (POW) consensus mechanism to a proof-of-stake (POS) in the Ethereum network could jumpstart the $40 billion staking industry.

They acknowledged that staking is already generating revenue worth approximately $9 billion in the crypto industry.

Ethereum 2.0 was launched in December 2020 to kickstart this transition.

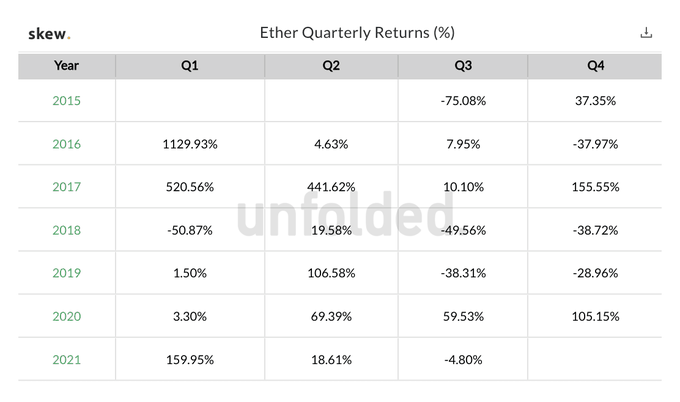

Ethereum outperformed Bitcoin in Q1 and Q2 of 2021

According to market insights provider unfolded:

“Despite high correlation with Bitcoin, Ethereum outperformed BTC in Q1 and Q2.”

As the debate on whether Ethereum will one day outdo Bitcoin, ETH’s daily active addresses recently surpassed those of BTC for the first time in crypto history.

Image source: Shutterstock

.jpg)