Long-Term Bitcoin Holder Supply Shock Hits a Record-High, Suggesting Price Could Surge in Months

On-chain analyst Will Clemente believes Bitcoin might witness a significant price appreciation in coming months based on the long-term holder supply shock.

Bitcoin (BTC) was a stone’s throw away from the psychological price of $50K during intraday trading. The leading cryptocurrency was up by 3.4% in the last 24 hours to hit $49,404, according to CoinMarketCap.

On-chain analyst Will Clemente believes this is the tip of the iceberg because Bitcoin might witness a significant price appreciation in the coming months based on the long-term holder supply shock. He explained:

“Long-term holder supply shock has reached all-time highs. Each time the metric has reached the upper bound of the highlighted green range, we've seen major price appreciation over the coming months. Buckle up.”

Long-term BTC holders have emerged to be notable players in the Bitcoin ecosystem as they set the accumulation ball rolling.

For instance, Bitcoin supply has been steadily maturing to long-term holders, given that nearly 2 million BTC have transitioned from short-term to long-term holders from the time an ATH price of $64.8K was attained in mid-April.

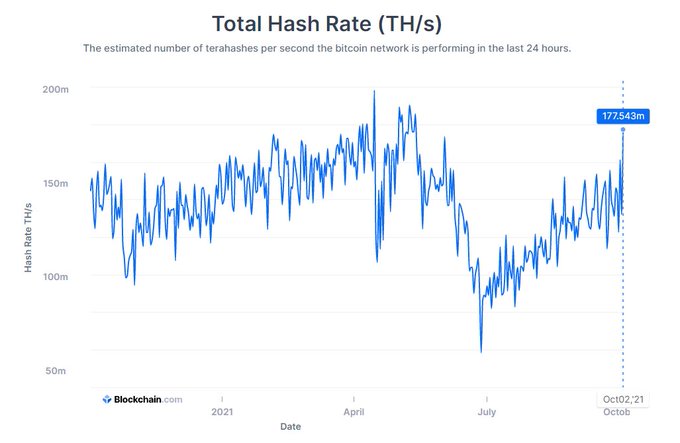

Bitcoin hash rate witnesses strong recovery

According to Charles Edwards, the founder of Capriole Investments:

“Bitcoin hash rate just hit April highs. A year ago, 60% of the network was in China. In May, the Bitcoin network had its legs and arms cut off. They completely regrew in just 6 months.”

Therefore, it shows the BTC hashrate has seen a substantial recovery ever since China intensified crypto mining in May.

For instance, Chinese authorities disconnected BTC mining sites in Sichuan in June. As a result, more than 90% of China’s crypto mining capacity was hampered.

The new development suggests that many BTC miners have successfully relocated to other regions, with earlier reports showing the United States had emerged as the biggest beneficiary.

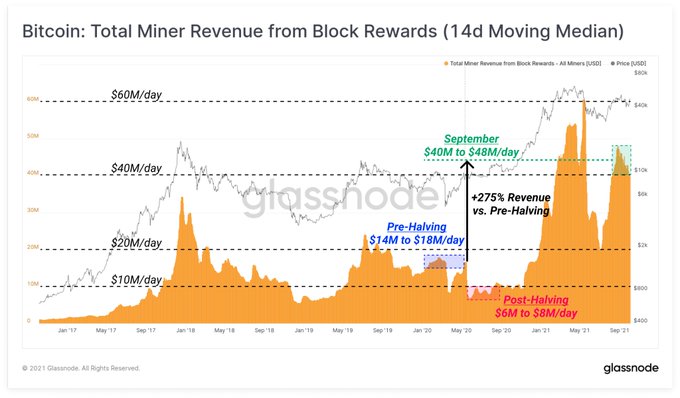

Bitcoin miners are heavily cashing in

Crypto analytic firm Glassnode noted:

“The total value paid to Bitcoin miners via the block reward (subsidy + fees) is hovering around $40M/day. Compared to the 2020 Halving, current USD miner revenue is: - 275% higher vs pre-halving (12.5 $BTC/block subsidy) - 630% higher vs post-halving (6.25 BTC/block subsidy).”

Meanwhile, El Salvador’s decision to use volcano power to mine Bitcoin (BTC) propelled the leading cryptocurrency’s quest to accelerate renewable energy development. Therefore, this approach boosted Bitcoin’s carbon footprint of making crypto mining green.

Image source: Shutterstock

.jpg)