Top Crypto Assets are in Fear Trajectory, Could this Signal a Bounce?

The crypto market continues to be in the red based on more liquidation. As a result, the leading cryptocurrencies are in the fear zone.

The crypto market continues to be in the red based on more liquidation, resulting in the leading cryptocurrencies being in the fear zone.

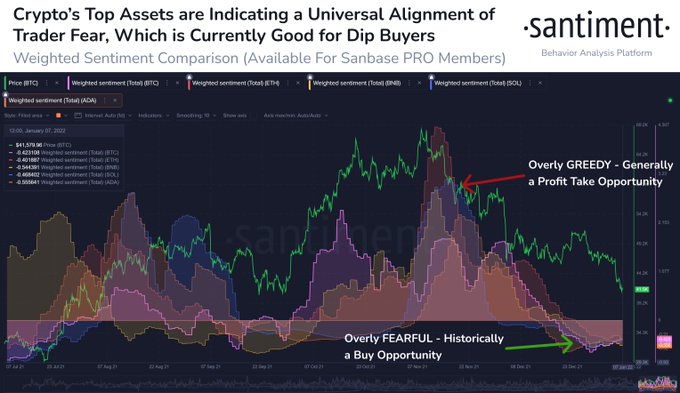

Market insight provider Santiment confirmed:

“Have we dipped low enough where there's "blood in the streets?" According to crowd sentiment, there's quite a bit of FUD & bearishness for BTC, ETH, BNB, SOL, & ADA. As illustrated by this chart, negativity correlates most commonly with bounces.”

Data analytic firm CryptoQuant echoed these sentiments and stated:

“Fear is in the air! Bitcoin Fear and Greed Index now at a level last seen in July.”

The crypto space has been bleeding because $300 billion was lost in just three days.

The slump in crypto prices is partly attributed to the U.S. Federal Reserve plans to raise interest rates in March. Therefore, there is a great probability that the Fed will raise interest rates this year amid significant discomfort with high inflation.

Furthermore, the Bitcoin hash rate dropped following the Kazakhstan internet shutdown intended to tame unrest that rocked the nation.

Therefore, the crypto market is experiencing fear, uncertainty & doubt (FUD). Nevertheless, this negative scenario in the market correlates with surges because it presents the “buy the dip” opportunity.

Market analyst Michael van de Poppe believes that there is light at the end of the tunnel for the crypto market because its capitalization is dipping into support.

Meanwhile, the crypto industry made notable strides in 2021. For instance, venture capital firms almost quadrupled the previous high by pumping a whopping $30 billion into the crypto sector.

With more growth being experienced in various areas like the metaverse, decentralized finance (DeFi), and non-fungible tokens (NFTs), it remains to be seen how the crypto market plays out in the short term.

Image source: Shutterstock

.jpg)