Bitcoin Whale Holdings Hit a 7-Month High, Despite Retail Investors Panicking

The $38K to $40K zone of Bitocin is proving to be a hard nut to crack in the market. Nevertheless, BTC whales have been accumulating heavily in this area.

Based on the back and forth witnessed, the $38K to $40K zone of Bitcoin is proving to be a hard nut to crack in the market.

BTC whales have been accumulating heavily in this area as their holdings continue to skyrocket. Market analyst Will Clemente noted:

“BTC whales’ holdings are now the highest since September of last year. This continued increase has honestly surprised me.”

Source: Glassnode

Clemente’s sentiments are based on the fact that even though Bitcoin recently nosedived below the psychological price of $40,000, whales are not relenting in their quest to purchase more coins because they see the drop as a buying opportunity.

Panic selling by retail investors might trigger uncertainty in the BTC market. Crypto analyst Rekt Capital acknowledged:

“On-chain analysis suggests that the number of unique addresses holding at least 10,000 BTC has been increasing on this recent retrace. Whales are accumulating while retail is panicking.”

The uncertainty brewing in the Bitcoin market can be illustrated by the formation of spinning-top candles at the weekly chart’s higher low. Rekt Capital pointed out:

“BTC is forming a spinning-top candle at the higher low. Spinning top candlesticks signal uncertainty in the market but also tend to precede trend reversals. Candles could change until the weekly close, but worth paying attention to the developing psychology.”

Source: TradingView

Higher highs and higher lows characterise an uptrend, whereas lower highs and lower lows depict a downtrend.

Is Bitcoin staring at a reversal?

According to market analyst Michael van de Poppe:

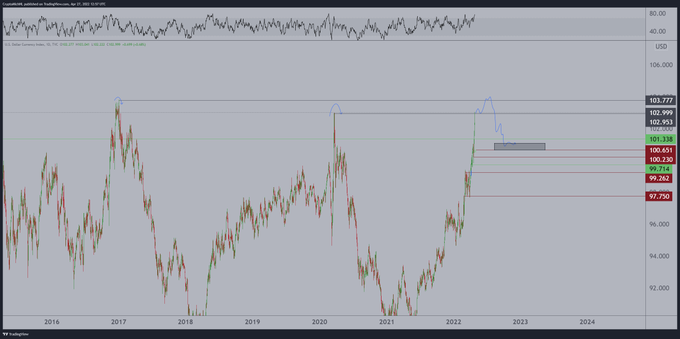

“When it comes to a potential Bitcoin reversal or break-out of this structure, we need a 'weak' Dollar to act. In that case, the DXY is approaching key levels with those previous highs. I think it's sweeping the highs there for liquidity and reverse -> equities & Bitcoin up.”

Source: TradingView

With the US dollar index (DXY) having an inverse relationship with Bitcoin, it is approaching a significant resistance zone. Once a reversal is witnessed, BTC is anticipated to surge in price.

Bitcoin recently experienced a bullish divergence, which also signalled that a reversal was on the horizon.

Image source: Shutterstock

.jpg)