Long-Term Bitcoin Holders Accumulate Heavily as Daily Active Addresses go Through the Roof

Long-term Bitcoin holders are still confident in the leading cryptocurrency because they accumulated heavily in the recent dip

Long-term Bitcoin holders are still confident in the leading cryptocurrency because they accumulated heavily in the recent dip, as Michael van de Poppe disclosed.

The market analyst explained:

“Long-term holders have been accumulating heavily in the recent dip/correction. Why? Because it's a gigantic buying opportunity.”

On-chain analyst Will Clemente recently echoed these sentiments by stipulating that BTC was moving to strong hands because its supply stock was at levels witnessed at the $50-$60K range.

Strong hands are investors who indulge in an asset for long-term or future purposes other than speculation.

Bitcoin whales have also been on a buying spree because they added 130,000 BTC to their holdings in the last 5 weeks. Crypto analytic firm Santiment stated:

“Bitcoin whales holding between 100 and 10,000 BTC continue accumulating since the May plummet that shook out many weak hands. These addresses have now accumulated 130,000 more BTC in the past 5 weeks, and 40,000 more in just the past 10 days.”

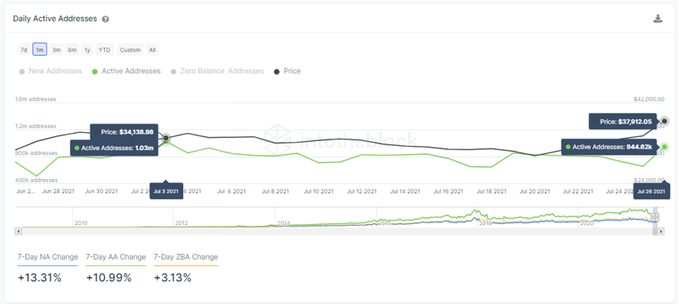

Bitcoin’s daily active addresses increase rapidly

Bitcoin topped the psychological price of $40K on Monday, July 26, after more liquidity was pumped into this market. As a result, the BTC funding rate flipped positive as 2.1 million Bitcoin returned to profitability.

Furthermore, the number of daily active BTC addresses surged by 44.1%. Data analytic firm IntoTheBlock acknowledged:

“During yesterday's volatile session, the number of Bitcoin daily active addresses increased by 44.1% compared to the previous day. Bitcoin daily active addresses tend to be correlated with the price action, as investors are usually following the price rather than using the asset.”

Meanwhile, the BTC derivatives market is showing bullish signs. For instance, positive funding rates across several exchanges were noted for the first time in over a month. Furthermore, open interest was on an upward trajectory. Therefore, time will tell how Bitcoin shapes up moving forward.

Image source: Shutterstock

.jpg)