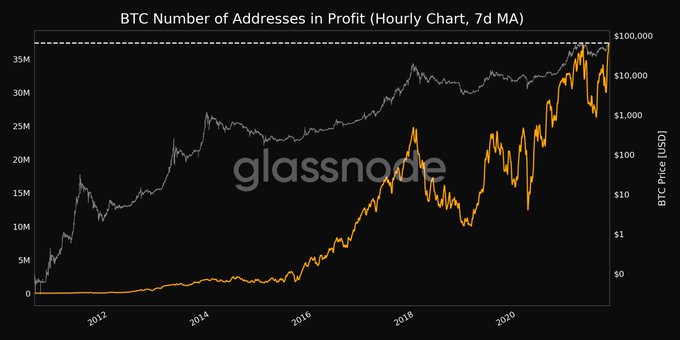

The Number of Bitcoin Addresses in Profitability Breaks the Record, Price Inches Closer to ATH of $64,800

The number of Bitcoin addresses in profit has reached a record high of 37,396,654.839. The market is expecting Bitcoin to break through $64.8K ATH level.

The crypto community is waiting with bated breath for Bitcoin to break the all-time high (ATH) price of $64,800 set in mid-April. This scenario might play out soon because BTC was hovering around $64,100 during intraday trading, according to CoinMarketCap.

This uptrend has made the number of Bitcoin addresses in profit reach a record high of 37,396,654.839, as revealed by on-chain metrics provider Glassnode.

Reportedly, 99.705% of BTC supply is in profitability.

Meanwhile, the value stored in the Bitcoin network is at an ATH based on the realized price.

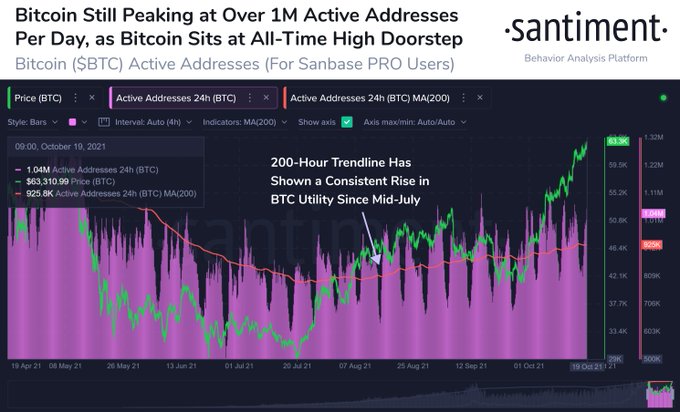

More than 1 million active BTC addresses are being recorded daily

According to Santiment, Bitcoin continues to peak, given that at least one million active addresses are being noted per day. The crypto insight provider explained:

“Address activity, circulation, whale/exchange activity, and sentiment are all playing major factors in history potentially being made for BTC.”

Will Bitcoin’s price go parabolic soon?

According to Charles Edwards, the founder of Capriole Investments:

“Historically, every time MVRV z-score reclaimed 3.0, Bitcoin went on a parabolic price run for the next 1-2 months. Bitcoin just reclaimed 3.0.”

Large-scale transactions have been trickling into the Bitcoin network. For instance, transactions worth at least $100,000 have been experiencing exponential growth.

Institutional investments have played an instrumental role in Bitcoin’s journey towards record-high prices. For example, big-money moves enabled the leading cryptocurrency to hit the record-high price of $64.8K.

Some of the corporate giants leading the institutional investment race include leading American business intelligence firm MicroStrategy. This company committed $242.9 million to purchase a new batch of Bitcoin, bringing its total holdings to 114,042 BTC.

With institutional investments and whale activities surging, whether this will prompt a new ATH price remains to be seen.

Image source: Shutterstock

.jpg)