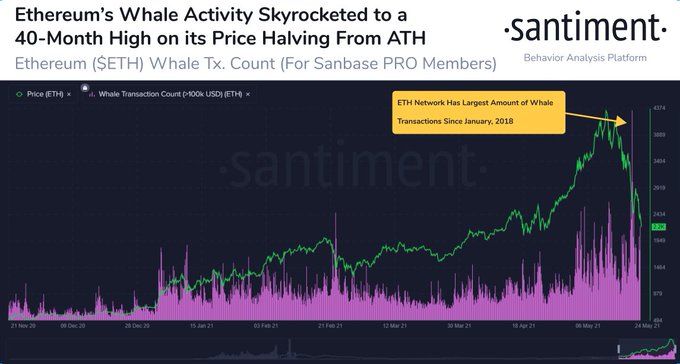

Ethereum Whale Transactions Ballooned to Levels Since January 2018

Brian Njuguna May 24, 2021 03:00

On-chain metrics provider Santiment acknowledged that ETH whale transactions went through the roof in the past week.

Ethereum (ETH) sank to lows of $2,000 followed by the market crash witnessed in the crypto space. As a result, the second-largest cryptocurrency shed off half of its market capitalization from the record-high of $500 billion witnessed recently.

ETH dropped from an all-time high (ATH) of $4,358 to a low of $2,015 in just one week. Ethereum, however, regained some momentum to trade at $2,367 at the time of writing, according to CoinMarketCap.

Santiment acknowledged that the amount of ETH whale transactions went through the roof over the past week. The on-chain metrics provider explained:

“The amount of Ethereum whale transactions (greater than $100,000 in value) ballooned to levels not seen since January 2018 this week.”

Meanwhile, crypto data provider Glassnode noted that the Ethereum supply active over the last five to seven years reached an ATH of 4.9 million ETH.

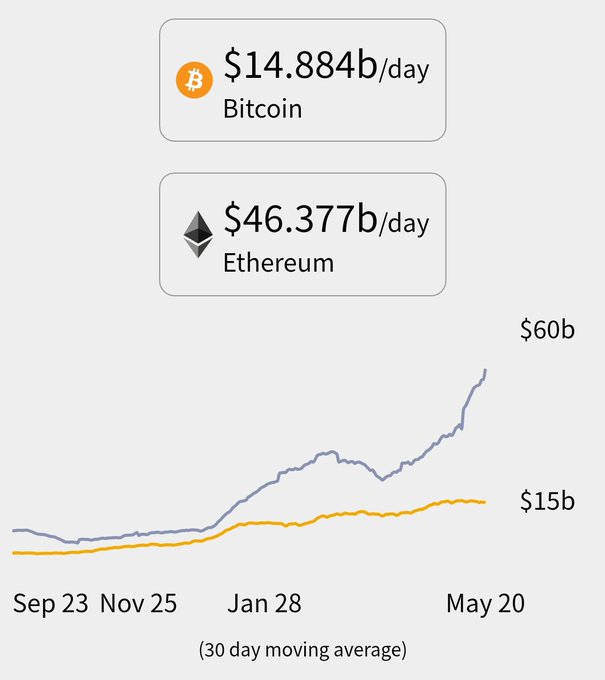

Ethereum transactions dwarf those of Bitcoin

According to market insight provider Documenting Ethereum, it said:

“Ethereum now settling 3x more value than bitcoin per day.”

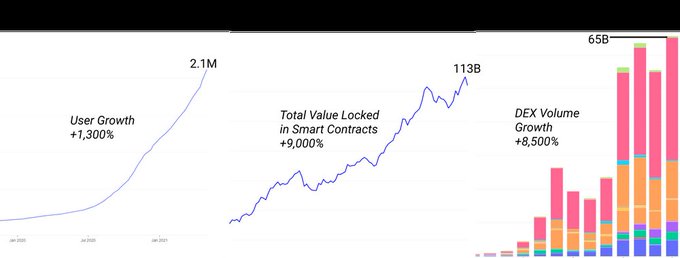

Furthermore, the decentralized finance (DeFi) on the ETH network has experienced an exponential expansion over the past few months as the number of users growth increased by 1,300%, hit to 2.1 million. The total value locked (TVL) in smart contracts shot up by 9,000% to stand at $113 billion.

Recently, Messari Crypto researcher Mira Christianto affirmed that ETH holders showed bullish signs as both centralized and decentralized exchanges were not showing an uptick in inflows.

Market analyst Lark Davis remains optimistic that Ethereum’s price headed for 5-digit figures. He stated:

“In 2021, Ethereum has EIP 1559 coming, the triple halving, moving to proof of stake, layer two scaling Arbitrum and Optimism, and increasing institutional adoption with Ark Invest leading the charge. 5 digit ETH is coming.”

Time will tell whether Ethereum will recover nearly half of the value it lost in the recent market crash.

Image source: Shutterstock

.jpg)