Tyler Winklevoss Predicts $500K BTC price as MassMutual Insurance Giant Buys up $100 million in Bitcoin

Lucas Cacioli Dec 11, 2020 02:55

MassMutual Insurance buys up $100 million in BTC for its portfolio, and Bitcoin billionaire Tyler Winklevoss appears to be gaining confidence in his $500,000 per BTC prediction.

As Bitcoin gains further mainstream momentum with US insurance giant MassMutual buying up $100 million in BTC for its portfolio, Bitcoin billionaire Tyler Winklevoss appears to be gaining confidence in his $500,000 per BTC prediction.

Bitcoin’s (BTC) mainstream appeal is gaining momentum as insurance giant Massachusetts Mutual Life Insurance Co. (MassMutual) buys up $100 million of the cryptocurrency for its general investment account.

According to the WSJ on Dec. 10, the $100 million BTC investment is actually quite small for the US-based insurance company whose general investment account totaled nearly $235 billion as of Sept. 30 this year.

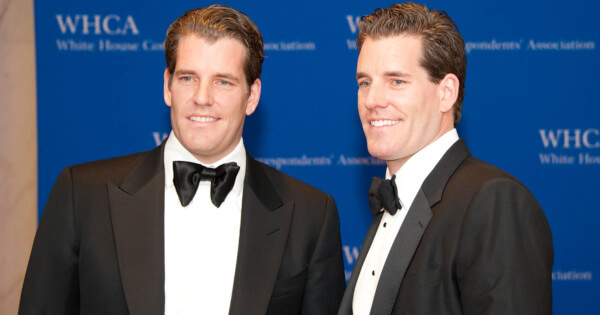

Gemini crypto exchange founder, Tyler Winklevoss has been very public in his prediction for the BTC price to reach $500K per crypto and replace gold as the preferred safe-haven asset.

While the investment may be a small one for the insurance giant, the move to diversify its portfolio with the pioneer cryptocurrency signifies further momentum for Bitcoin and its acceptance as a safe have asset according to Winklevoss.

As the Wall Street Journal broke the news of MassMutual’s $100 million BTC investment, Winklevoss tweeted:

“And another domino falls on the yellow brick road to #Bitcoin being worth $500k per bitcoin. Who's next?”

MassMutual purchased the Bitcoin through a New York-based fund management company called NYDIG, which has over $2 billion in BTC and crypto-assets under management. MassMutual also acquired a $5 million minority equity stake in NYDIG, as reported by the WSJ.

The Bitcoin price reached a new all-time high in late November at $19,835, topping its 2017 high, and is currently trading under the $18,000 level, approximately gaining 150% year-to-date.

Market Cap of $9 Trillion and BTC Price of $500,000 by 2030

In a recent interview with CNBC, Tyler and Cameron Winklevoss predicted that the Bitcoin price will surge to $500,000 and replace gold as a store of value with a $9 trillion market cap by 2030.

The Gemini crypto exchange co-founders said in the that Bitcoin is a better store of value than gold and BTC’s market cap will likely grow to around $9 trillion as it transforms into gold 2.0.

Tyler Winklevoss said:

"Our thesis is that Bitcoin is gold 2.0, that it will disrupt gold, and if it does that, it has to have a market cap of $9 trillion, so we think it could price one day at $500,000 of Bitcoin.”

According to the billionaire Bitcoin investors, the room for BTC’s price growth makes it a good investment even at its current high levels.

"So at $18,000 bitcoin, it's a hold or at least if you don't have any, it's a buy opportunity because we think there's a 25x from here."

The Winklevoss’s are firm believers in Bitcoin’s and explain its sensational surge as being due to an increasing number of retail and institutional investors realizing that BTC is the best store of value against inflation offering much higher returns than gold.

Image source: Shutterstock.jpg)