US Treasury to Increase DeFi Regulation

Terrill Dicki Apr 23, 2023 07:41

The US Treasury conducted a risk assessment of DeFi, finding it lacking in AML/CFT compliance, and reported money laundering, scammers, and North Korean hackers benefiting from the sector. The Treasury response to Biden's executive order suggests more regulation for DeFi, including compliance with the Bank Secrecy Act.

The decentralized finance (DeFi) sector has been booming in recent years, with a plethora of new projects and services popping up every day. However, with its rapid growth comes increased scrutiny from regulators, and the United States Treasury recently conducted a risk assessment of the sector to identify potential risks and areas where it may be lacking in compliance.

According to Assistant Treasury Secretary for Terrorist Financing and Financial Crime Elizabeth Rosenberg, the report found that DeFi was lacking in several ways, particularly in terms of Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) compliance. She stated that the lack of compliance had allowed scammers, money launderers, and North Korean hackers to benefit from the sector, which is a major concern for the Treasury.

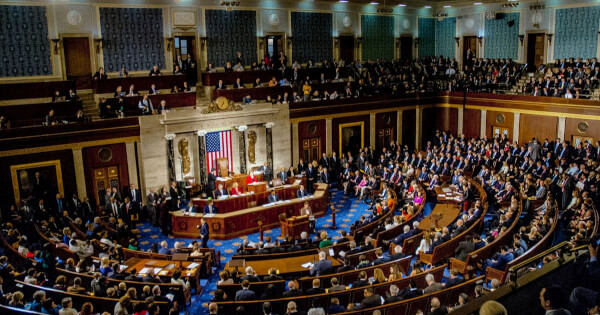

Rosenberg spoke about the report's findings at a recent event hosted by the Atlantic Council think tank, and she warned that the sector should be prepared for increased regulation in the future. The report was part of the Treasury's response to U.S. President Joe Biden's executive order on the responsible development of digital assets, which calls for increased oversight and regulation of the crypto industry.

One of the report's key findings was that DeFi was not always as decentralized as it claimed to be. Many of the services and persons associated with DeFi services were found to be subject to AML/CFT obligations, meaning they were liable to comply with the Bank Secrecy Act. The report concluded that all DeFi services must comply with the Act, which is a major step towards increased regulation of the sector.

While some in the DeFi community may be concerned about the potential for increased regulation, others see it as a necessary step to ensure the sector's long-term success. With more oversight and compliance measures in place, investors and users can be assured that they are participating in a safe and secure ecosystem that is less vulnerable to fraud and illicit activities.

Overall, the US Treasury's risk assessment of DeFi has highlighted the need for increased compliance and regulation in the sector. As the DeFi industry continues to grow and evolve, it will be important for all participants to ensure they are following the necessary AML/CFT guidelines and complying with applicable laws and regulations. By doing so, they can help to create a more secure and sustainable future for the sector.

Image source: Shutterstock.jpg)