Search Results for "general tax law"

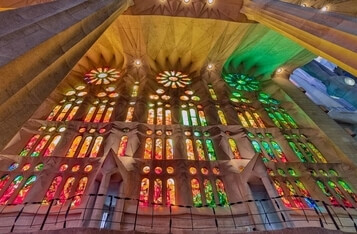

Spain Strengthens Crypto Oversight to Settle Tax Debts

Spanish Ministry of Finance is implementing legislative reforms to increase cryptocurrency monitoring, enabling seizure of digital assets for tax debt resolution, aligning with EU regulations.

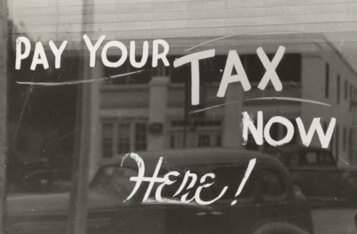

IRS Cracking Down on Cryptocurrency Tax Evasion, Seeks Private Crypto Tax Contractors

The Internal Revenue Service (IRS) has requested help from independent consultants to crack down on non-compliance in cryptocurrency tax.

Trump’s Proposed Capital Gains Tax Cuts Could Benefit Ethereum 2.0 Stakers

President Donald Trump has proposed a capital gains tax cut which may greatly benefit United States cryptocurrency traders—particularly those planning to stake on Ethereum 2.0.

IRS Updates 1040 Income Tax Form, Lays Traps for Crypto Tax Cheats

The IRS plans to update the 1040 income tax form for 2020 to make it more difficult for taxpayers to avoid declaring their crypto assets.

South Korea Contemplates Imposing 20% Tax on Cryptocurrency Proceeds

The South Korean administration might consider categorizing proceeds from cryptocurrency transactions as other income that is subjected to 20% tax, such as prize-winning or lottery.

Peter Schiff’s Bank Investigated in Global Tax Evasion Probe, Gold May Be Dirty

Peter Schiff’s Euro Pacific Bank is currently under a tax evasion probe for hosting numerous financial accounts suspected of tax evasion crimes.

South Korea Plans to Postpone Cryptocurrency Tax Rule to January 2022

South Korea is planning to delay the implementation of its crypto income tax rules to January 2022, extending it from its previous time frame of October 2021.

US Congress Reveals most Countries Fail to Tax Staked Crypto, Will This be Resolved as Ethereum Launches Staking?

Taxation for cryptocurrencies differ from one country to another and most have yet to provide clear guidelines on how to tax staked crypto.

Former Microsoft Employee Convicted of $10M Bitcoin Tax Fraud Scheme

A former Microsoft employee is facing nine years in prison for defrauding the tech firm of more than $10 million in digital currency.

US Tax Office Warns Coinbase Users To Declare Crypto Holdings Before IRS Clampdown

The IRS may soon start clamping down on crypto users particularly those affiliated with Coinbase exchange who do not properly report their crypto holdings.

Libra Association Appoints Former Homeland Security General Counsel to Head Its Legal Services

Libra appoints Stevan Bunnell, former Homeland security department general counsel, as its own general counsel.

Canadian Tax Agency Asks Coinsquare Crypto Exchange to Hand Over Clients Personal Data

The Canada Revenue Agency has requested a judge of the Federal Court to force a crypto exchange to hand over information about all its customers.