Search Results for "gbtc"

Grayscale's 33% GBTC Premium Signals “Outrageous” Institutional Demand For Bitcoin, says Willy Woo

Grayscale Bitcoin Trust's (GBTC) premium on Bitcoin has risen to 33%, indicating “outrageous demand” for BTC from institutional investors as its price consolidates at $23,000.

What is Grayscale Bitcoin Trust (GBTC)?

The Grayscale Bitcoin Trust is an investment vehicle that is designed to enable investors to trade Bitcoin shares without actually owning BTC.

Grayscale AUM up $3.4 Billion in a Week, $500 Million in a Day, GBTC 33% Premium Shows High Bitcoin Demand

Institutional-grade digital asset manager, Grayscale Investments is up $3.4 billion in assets under management (AUM) over the last week, bringing total AUM to $16.4 billion.

Grayscale Files with US SEC to Convert GBTC Into Bitcoin Spot ETF

Grayscale believes that if the SEC approves a futures-based ETF, the agency should be open to approve the physical based ETFs.

Grayscale Bitcoin Trust (GBTC) Registers with SEC Amid Market Volatility

Grayscale Bitcoin Trust (GBTC) files SEC registration, transitioning to NYSE Arca listing amid ongoing market volatility and evolving digital asset landscape.

Bitcoin Surges Past $28,000 and GBTC Discount Narrows to 17%

Bitcoin's value surged to $28,142 on Binance after Grayscale Investments won a lawsuit against the SEC, converting its Grayscale Bitcoin Trust into an ETF.

Grayscale Goes to Court After SEC Rejects its Proposed ETF Bid

The United States Securities and Exchange Commission (SEC) dashed the hopes of Grayscale Investments with a rejection of its application to convert the Grayscale Bitcoin Trust product to a full-spot Exchange Traded Fund (ETF)

Digital Currency Group Raises $700M at $10B Valuation

The Digital Currency Group (DCG) has announced its latest secondary share sale in which it pulled about $700 million in funding.

Grayscale Launches New Crypto Dealer as Genesis Got Incapacitated With 3AC Bankruptcy

Grayscale Investments, one of the largest asset managers in the digital currency ecosystem has launched a new broker-dealer dubbed Grayscale Securities, recent filings with the United States Securities and Exchange Commission show

GBTC's Discount to NAV Hits New Record Low after SEC Declining its Bitcoin Spot ETF Application

Grayscale’s flagship product GBTC has continued to widen its discount. The discount signals the poor performance of the Bitcoin fund. As a solution, Grayscale wants to convert the GBTC into a spot Bitcoin ETF.

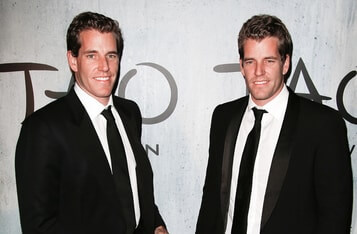

Gemini Co-founder Marks Spot Bitcoin ETF Approval Struggle for A Decade

The 10-year anniversary of the day that Cameron Winklevoss and his brother Tyler filed for the top slot in the first Bitcoin Exchange-Traded Fund (ETF) was celebrated today by the co-founder of the cryptocurrency exchange Gemini.

ARK Invest Intensifies Investment in Robinhood

ARK Invest, led by Bitcoin enthusiast Cathie Wood, increased its stake in Robinhood, buying 1.1 million shares worth over $9.5 million in a single day. The investment was distributed across three ARK ETFs, with ARKK acquiring the majority.