Search Results for "clabs"

German Authorities Clamps Down on 'Shitcoins club' Bitcoin ATM Operations

Germany’s financial regulator (BaFin) has moved to stop the operations of Shitcoins Club, a popular Bitcoin ATM operator in the country.

Celo Foundation: cLabs Introduces Dango, a New Layer-2 Testnet for Celo

cLabs unveils Dango, a Layer-2 testnet for Celo, enhancing blockchain performance and scalability with Optimism’s OP Stack.

CFTC Charges Four Individuals Behind Alleged Bitcoin Fraud Scheme "Global Trading Club"

The Commodity Futures Trading Commission has charged four people for allegedly soliciting funds from clients to speculate in Bitcoin price movements.

Chelsea Football Club Owner Abramovich Confirmed as Investor in Telegram's 2018 ICO

The US Securities and Exchange Commission’s (SEC) investigation into Telegram’s $1.7 billion initial coin offering (ICO) in 2018 has revealed that some very big names took part in the unregistered offering.

Italian Soccer Giant Juventus Embraces Blockchain Technology

In a move widely celebrated by fans, Juventus Football club of Italy enters into a licence agreement with blockchain based fantasy football company, Sorare.

Australian Football Club Perth Glory FC to be Tokenized by New Owners London Football Exchange

Sports clubs and cryptocurrency, will this lead to a new method of ownership in global sports?

Power Ledger Partners with Power Club To Roll Out Blockchain Plants in South Australia

Powerledger enters into a partnership with Powerclub, an Australian electricity wholesaler for better energy usage, allowing the integration of power club's blockchain ledger application.

FC Barcelona Fan Tokens Worth $1.3 Million Sold Out in Two Hours

FC Barcelona Fan Tokens (BAR) got sold out barely 2 hours after it went live on sale. With BAR, fans all over the world will be more engaged in the decision at the club.

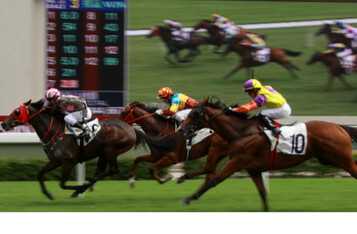

Unauthorized Cryptocurrency Betting Jeopardizes Jockey Racing Integrity, Warns HKJC Expert

During a presentation at the Asian Racing Conference in Cape Town, South Africa, Tom Chignell, a Hong Kong Jockey Club expert, warned that illegal cryptocurrency betting markets could seriously compromise jockey racing integrity.

Vitalik Buterin Presents Ethereum 2.0: The Three Things You Need to Know

Vitalik Buterin, having recently attended DevCon 5 held in Osaka Japan, visited Hong Kong at the Hong Kong Jockey Club University of Chicago Academic Complex, at an Ethereum Meetup hosted by the Polsky Center for Entrepreneurship and Innovation at The Hong Kong Jockey Club University of Chicago Academic Complex | The University of Chicago Francis and Rose Yuen Campus in Hong Kong along with the Fintech Association of Hong Kong.

The Sale of Perth Glory FC Seems Dead in the Water Based on the Crypto Firm’s Dark Past

The proposed sale of Perth Glory FC, an Australian soccer club, has been thrown into disarray following allegations that the potential buyers have an ongoing fraudulent misrepresentation case in the UK High Court. The claims point out that London Football Exchange (LFE), a London-based cryptocurrency company, and its owner Jim Aylward were facing a $2.2 million USD lawsuit brought forth by a Turkmenistan oil trader.

Alex Fazel of Swissborg, on Financial Freedom, Predicting the Price of Bitcoin and Breakdancing

Alex is one of the founding members of Swissborg founded two years ago to open the world of finance to all. His brother and CEO Cyrus had been working in investment banking but was struck by how he was only helping the rich get richer - a position with which he was not comfortable. And so the ambition of opening up the priviate members club of finance was born.